High Risk

|

Low Risk

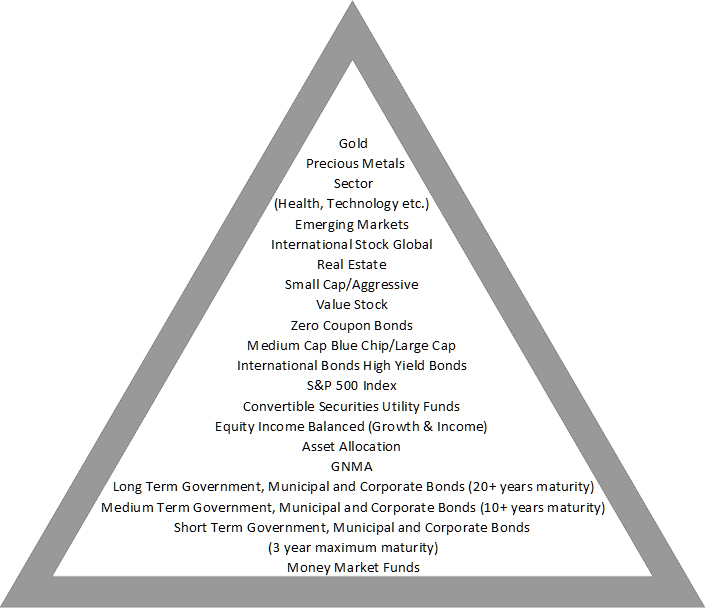

Investment Pyramid

A Mutual Fund

is a company that combines the investment funds of many people with similar investment goals and invests the funds for these people in a wide variety of securities. The individual receives shares of stock in the mutual fund and through the mutual fund are able to enjoy much wider investment diversity than they could otherwise receive. Each shareholder, in effect, owns a part of a diversified portfolio that has been acquired with the pooled money. As the securities held by the fund move up or down in price, the market value of the mutual fund shares moves accordingly. When dividend and interest payments are received by the fund, they are passed on to the mutual fund shareholders and distributed on the basis of prorated ownership.

The above is a simple non technical chart of Mutual Fund categories by risk and reward. It should help you understand some basics of risk and reward. This is not an exact science, this chart is not intended to be 100% accurate. At the top of the pyramid an individual can expect the greatest returns but because of the risk associated with these funds an individual will also experience the greatest risk of loss. Consequently, with the funds at the bottom of the pyramid an individual can expect low returns with the lowest risk of loss of investment. Volatility is the key. If an individual knew exactly when to invest in these funds and exactly when to sell these funds he or she would be able to maximize his or her return.

Pyramid Strategy

Before moving up the pyramid and taking on more risk you should "cover your basics first". That's why treasury instruments and insured deposits are shown first. Bonds are included next since, historically, they are less volatile than stock- meaning their returns do not fluctuate as greatly, however, past performance does not guarantee future recurrence or results. Basic stock index funds are usually next in line followed by more aggressive positions until you reach the top and are involved in speculative investments.

As a general guide, you should put part of your money in the safer areas first before investing in more risky investments. If you are young and the more money you make, and if you have few or no dependents, theoretically you can take on more risk. You have more time to recoup your losses. Consequently, as you get older you should reduce your risk exposure because there is less time to make up losses. However, you should never make an investment unless you clearly know what you are investing in.

Money Market Funds

Money market funds are not FDIC insured. They invest in short term government, municipal or corporate bonds with less than 12 months to maturity and try to maintain a $1.00 per share value. Some funds may use derivatives in an attempt to increase return. You should read the prospectus carefully to determine what the fund managers can and have been doing. It is possible to lose money by investing in money market funds.

Short Term Government, Municipal and Corporate Bond Funds

Theses bond funds usually have maturities no longer than 3 years. Normally, the longer the period, the greater the risk and the greater the opportunity for a higher yield. Ratings by the various financial rating services also come into play. The higher the rating, the lower the risk, everything else being equal. Government and municipal securities generally have higher ratings than corporate securities and usually yield less. Managers in almost all bond funds continually buy and sell bonds, so the fund itself has no maturity date. Because they are bond funds, investments in these funds could drop in value if interest rates in the economy were to rise.

Medium Term Government, Municipal and Corporate Bond Funds

These bond funds usually have an average maturity around 10 years though there is no set time period. Typically, they are more volatile than the shorter term bonds and typically tend to yield more. Long Term Government, Municipal and Corporate Bond Funds: Typically these bond funds usually have an average maturity around 20 years though there is no set time period. They typically tend to drop more in value when interest rates go up and typically increase more when interest rates go down.

GNMA Funds- Government National Mortgage Association

GNMA's comprise a pool of residential mortgages and are backed by the U.S. Government. However, the GNMA guarantee is limited to only a mortgage default (nonpayment of monthly premium) and has nothing to do with the possibility that the principal may go up or down as interest rates in the economy change. An interesting characteristic of GNMA's is that they do not necessarily move in the same direction as government, municipal or corporate bonds. The reason for this, as economic interest rates go down, people with mortgages will usually refinance at the lower rates. As they refinance, more money is brought back into the pool and then loaned out at a lower interest rate making the return lower and the GNMA fund value drop. When economic rates rise, the value of principal may drop since you hold a portfolio of lower yielding mortgages. If economic rates stay flat, GNMA funds will tend to earn more than comparable bond funds. But if rates move up or down very much, the total return on GNMA funds may be less than other bond funds.

Asset Allocation Fund

Asset allocation funds tend to reduce risk by using a combination stocks, bonds and cash. The use of three non related securities is an attempt to reduce risk. Cash and bonds have historically lower volatility than stocks, however, past performance does not guarantee future recurrence or results. More bonds are used when stocks are not doing well and more stocks are used when the market is growing well. Larger cash positions are used when neither bonds or stocks are doing do well. Different mutual funds use different ratios even given the same economic conditions.

Balanced Funds

Balanced funds are similar to asset allocation however they use stocks and bonds only. They tend to use 60% in stocks and 40% in bonds and usually do not change much even when the economics change. Stocks and bonds together tend to lower volatility (risk). They also tend to have lower returns than pure stock funds.

Equity Income Funds

Equity Income funds normally use stocks that generate consistent income through dividends. The fund also appreciates if the stock market increases and lose value when the stock market falls.

Utility Funds

Utility funds invest in Utility company stocks and are similar to equity income funds due to their income payouts.

Convertible Securities Funds

Convertible securities are bonds that can be converted into stock in the company under certain conditions. The bonds normally have a yield less than standard bonds due to the convertibility. The value also is dependent on the movement of the underlying stock increasing the risk to your investment.

S&P 500 Index Funds

Funds that invest in a representative portion of the stocks in the S & P 500. It represents a broad selection of stocks in the marketplace.

High Yield Bond Funds

High Yield Bond Funds Bonds are rated from AAA down to D. Bonds rated BBB and above are called "investment grade". Bonds rated below BBB are usually called "junk bonds" and tend to pay a higher yield because of their lower rating. High yield securities inherently have a high degree of market risk. There are credit risks associated with the underlying issuers of high yield securities in addition to the lack of liquidity associated with these types of securities that may impair their value.

International Bond Funds

International Bonds may earn higher returns than U.S. bonds. They Have a higher risk than U.S. Bonds due to currency fluctuations. If the dollar appreciates returns can drop appreciably.

Blue Chip and Large Capitalization Stock Funds

These funds represent the bigger and more historically successful companies, however, past performance does not guarantee future recurrence or results. These companies represent continued growth based on past performance. Many have also shown a history of paying dividends. The risk is identified as higher than the 500 index overall since the selection represents just one section of the marketplace - not a broad coverage.

Medium Capitalization Stock Funds

Companies in these funds are not quite as large as those listed in the large capitalization stock funds above and may provide some greater element for growth. These companies are considered middle of the road providing a little of both- reasonable growth with acceptable risk.

Zero Coupon Bond Funds

Zero Coupon bonds can be government, corporate or municipal bonds. These are unique bonds in that they do not provide a cash flow. The bonds are bought at a discount and the face value is paid out at maturity. For example, a $10,000 face amount bond can be bought today for $6000 with a maturity in 10 years. At the end of ten years, the bond can be cashed in for $10,000. During the 10 years the bond is earning interest, unless the bond is tax exempt, the bearer of the bond is subject to income taxes on the interest each year.

Value Stock Funds

Value stock funds represent companies that are considered undervalued. These may be companies that have poor histories but may be on the brink of recovery. Their statistical ratios are less than other companies that are currently doing well.

Small Capitalization/Aggressive Growth Stock Funds

These represent smaller companies that historically have been shown to grow faster and have higher appreciation than larger companies with greater volatility, however, past performance does not guarantee future recurrence or results. They tend to pay little, if any, dividends because they put earnings back into the business.

Real Estate Funds

These funds invest in the stock of companies primarily devoted to real estate activity either through building, financing and other real estate related services. It is one of the few ways of investing in real estate while allowing almost complete liquidity. One reason an investor would include this investment category is that this industry's movements are not directly correlated with the movements of the stock or bond markets. It allows growth independent of those markets. These funds may be subject to a higher degree of market risk than funds whose investments are more diversified.

Global Funds

Global funds purchase stocks of foreign countries as well as the United States. Therefore the risks and returns are based on the proportion invested in the various countries- but are not solely tied to non U.S. stocks. There is currency risk related to any investments in stocks in foreign countries.

International Stock Funds

These are mutual funds that can invest in companies located anywhere outside of its investors' country of residence. Some funds will pick stocks of any country- some will focus on the Pacific Basin, Latin America, Europe, etc.

Emerging Foreign Markets

These funds invest in stock markets of emerging countries. It is a very difficult area to be an expert in. The stock markets in foreign countries are not required to adhere to the same reporting standards as required under the Securities Exchange Commission. Managers buying stocks in these countries must do extra work in analyzing the companies they are interested in.

Single Country Funds

These funds invest in one country only and risk is tied to only their performance. These funds may be subject to a higher degree of market risk than funds whose investments are more diversified.

Sector Funds

Sector funds focus the majority of its investments in only one area- health, technology, computers. Sector funds must have at least 25% of their portfolios in the area selected. These funds may be subject to a higher degree of market risk than funds whose investments are more diversified.

Gold and Precious Metals Funds

These funds are always at the top of a pyramid and should only be used when you can afford a high risk. There is a lot of volatility in this area. Investing in these areas could result in substantial loss.

Actual investment return and principal value of investments will fluctuate so that investor shares, when redeemed, may be worth more or less than their original cost. A plan of regular investing does not assure a profit or protect against loss in a declining market. You should consider your financial ability to continue your purchase throughout periods of fluctuating price levels. Please obtain a prospectus for complete information including charges and expenses. Read it carefully before you invest or send money.

© Copyright